If you’re looking to invest in the Singapore stock market, opening a CDP account is a crucial first step. A Central Depository (CDP) account is a type of account that allows you to hold and manage securities such as stocks, bonds, and exchange-traded funds (ETFs) in Singapore. With a CDP account, you can buy and sell securities on the Singapore Exchange (SGX) and keep track of your investments in one place.

Thankfully, opening a CDP account in Singapore is a straightforward process that can be done entirely online. The online application process is simple, and most of the information required is already prefilled for you if you use MyInfo via SingPass. Whether you are a Singapore resident with a SingPass login or have a passport from other nationalities, you can now apply and open a CDP account online, without having to submit hard copies of supporting documents.

Key Takeaways

- Opening a CDP account is a crucial first step to investing in the Singapore stock market.

- The online application process is simple and can be done entirely online.

- With a CDP account, you can buy and sell securities on the Singapore Exchange (SGX) and keep track of your investments in one place.

Understanding CDP Accounts

If you are looking to invest in Singapore’s stock market, you will need to open a Central Depository (CDP) account. A CDP account is a mandatory account that allows you to own Singapore-listed stocks, bonds, and other securities in your own name. In this section, we will discuss the benefits of a CDP account and the difference between a CDP account and a brokerage account.

Benefits of a CDP Account

A CDP account offers several benefits to investors. Firstly, it allows you to own securities in your own name, which means you have full control over your investments. Additionally, you will receive dividends and have the right to vote on important company matters. Furthermore, a CDP account provides a transparent and secure way to hold your securities, which helps to reduce the risk of fraud.

Difference Between CDP and Brokerage Accounts

A brokerage account is an account that you open with a brokerage firm to buy and sell securities. In contrast, a CDP account is a mandatory account that you need to open with the Central Depository (CDP) of the Singapore Stock Exchange. The main difference between the two is that a brokerage account allows you to trade securities, while a CDP account only allows you to hold securities.

When you buy securities through a brokerage account, your broker will hold the securities on your behalf. In contrast, when you buy securities through a CDP account, you will hold the securities directly in your own name. This means that you will have full control over your investments, and you will receive dividends and have the right to vote on important company matters.

In summary, a CDP account is a mandatory account that you need to open if you want to invest in Singapore’s stock market. It provides several benefits to investors, such as full control over your investments, the right to receive dividends and vote on important company matters, and a transparent and secure way to hold your securities. Remember that a CDP account is different from a brokerage account, which is an account that you open with a brokerage firm to buy and sell securities.

Eligibility and Requirements

To open a CDP account online in Singapore, you must meet certain eligibility criteria and provide the required documents. Here are the basic eligibility criteria:

Basic Eligibility Criteria

- You must be at least 18 years old.

- You must not be an undischarged bankrupt.

- You must have a Singapore bank account from one of the following banks: Citibank, DBS/POSB, HSBC, Maybank, OCBC, Standard Chartered Bank, or UOB.

- You must have a tax identification number (TIN) or a tax residency status.

Required Documents

To open a CDP account online in Singapore, you will need to provide the following supporting documents:

- A photocopy of your identification, such as your passport or National Registration Identity Card (NRIC).

- An approved bank account document, such as a bank statement or a bank book.

- Your MyInfo profile, which contains your personal information and is linked to your SingPass account.

- Your SingPass account, which is a secure login that allows you to access government e-services in Singapore.

- Your Central Provident Fund (CPF) statement, which shows your CPF balances and contributions (if applicable).

It is important to note that the above documents must be submitted in a clear and legible format. Any incomplete or illegible documents may result in delays or rejection of your application.

Opening a CDP account online in Singapore is a straightforward process, but it is important to ensure that you meet the eligibility criteria and provide all the required documents. Once your application is approved, you will be able to access your CDP account and enjoy the benefits of investing in the Singapore stock market.

The Online Application Process

Opening a CDP account online is a straightforward process. Here, we will guide you through the steps to register online via the SGX website and link your trading account.

Registering Online via SGX Website

The first step in opening an individual CDP account is to create an account online through the SGX website. If you are a Singaporean or PR, you can use MyInfo to pre-fill most of the required information. For non-Singaporeans and non-PRs, you will have to fill out the online form and provide supporting documents.

To register online, follow these steps:

- Go to the SGX website and click on the “Open a CDP Account” button.

- Select your preferred sign-up method: “Sign up using MyInfo” or “Sign up using the online form with supporting documents.”

- Fill in your personal details and upload the necessary documents.

- Review and confirm your application.

Once your application is approved, you will receive a confirmation email from CDP.

Linking Your Trading Account

After creating your CDP account, the next step is to link it to your trading account. This will allow you to start trading securities listed on the SGX.

To link your trading account, follow these steps:

- Download the CDP account opening form from the SGX website.

- Fill in the required information and sign the form.

- Submit the form to your brokerage firm.

- Your brokerage firm will process your request and link your trading account to your CDP account.

It is important to note that you must have trading experience before opening a CDP account. If you are new to trading, it is recommended that you seek guidance from a financial advisor or attend trading courses before opening an account.

Overall, opening a CDP account online is a hassle-free and convenient process. By following the steps outlined above, you can easily open an account and start trading securities listed on the SGX.

Managing Your CDP Securities Account

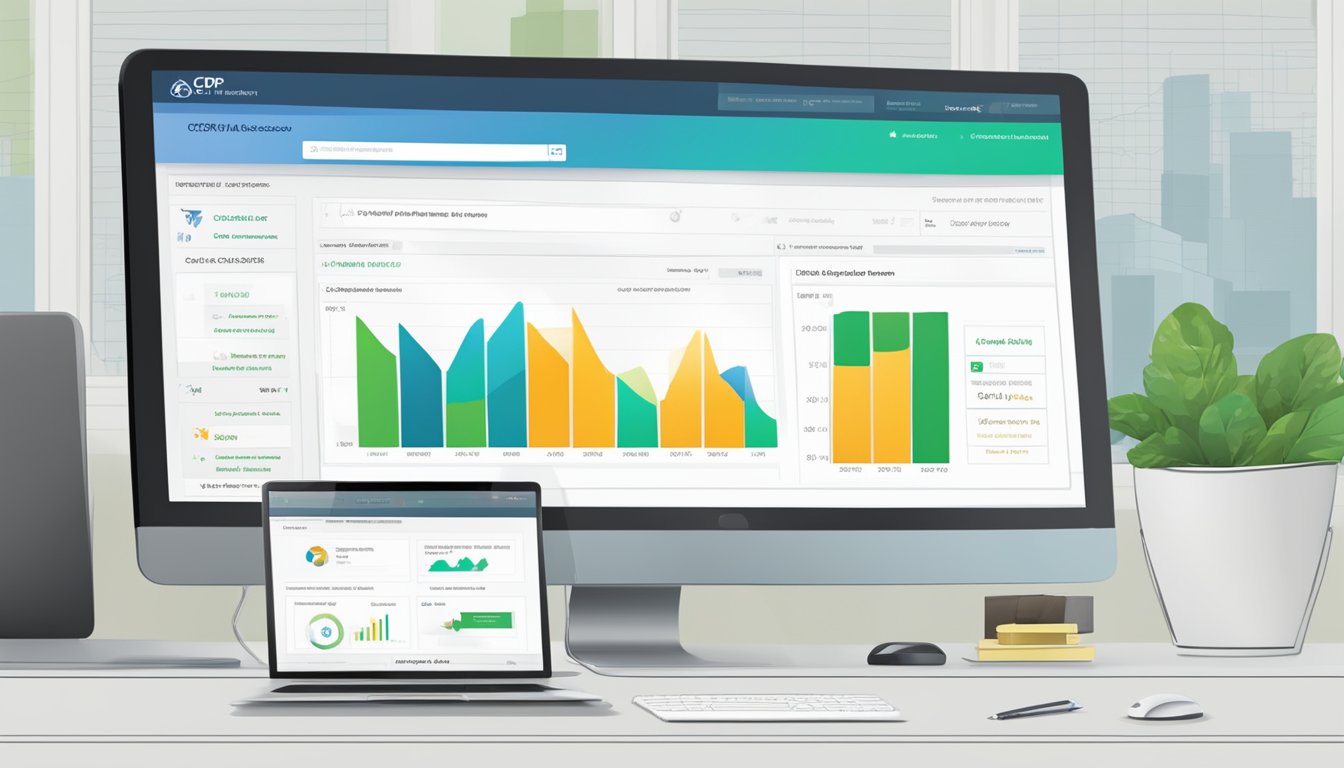

As a Singaporean investor, managing your CDP Securities Account is an essential part of your investment journey. There are several things you need to know about managing your account, including understanding portfolio and corporate actions and accessing your account through various platforms.

Understanding Portfolio and Corporate Actions

Your CDP Securities Account provides an integrated clearing, settlement and depository facility for equities and fixed income instruments such as corporate bonds and retail bonds. You can access your portfolio and view your holdings through the CDP Internet portal. This portal also allows you to update your contact details and view corporate actions such as dividends, rights issues, and bonus issues.

It is important to stay up-to-date with corporate actions as they can affect the value of your holdings. You can choose to participate in these actions or opt-out depending on your investment strategy. Keep in mind that some corporate actions may require you to take action within a specific timeframe.

Accessing Your Account Through Various Platforms

There are several platforms you can use to access your CDP Securities Account. The CDP Internet portal allows you to view your portfolio and corporate actions, update your contact details, and access CDP Forms. You can also access your account through the SGX Investor Portal, which serves as a one-stop access for stock investors.

If you prefer to trade on the go, you can download the SGX Mobile App, which allows you to access real-time market data and trade on the go. You can also access your account through your designated trading platform, which may have additional features such as charting tools and advanced trading options.

Overall, managing your CDP Securities Account is an important part of your investment journey. By understanding your portfolio and corporate actions and accessing your account through various platforms, you can stay up-to-date with your investments and make informed decisions to achieve your investment goals.

Maximising Your Investment Potential

As a retail investor, opening a CDP account in Singapore is a crucial step towards building a successful investment portfolio. With a CDP account, you can easily explore different investment products and sectors, and keep track of your dividends and corporate actions. Here are some ways you can maximise your investment potential with a CDP account.

Investing in Stocks, Bonds, and ETFs

One of the main benefits of having a CDP account is the ability to invest in a wide range of securities, including stocks, bonds, and ETFs. With access to the SGX platform, you can easily buy and sell securities at your convenience, giving you greater control over your investment portfolio.

When investing in stocks, it is important to do your research and choose companies that have a strong track record of performance and growth. You can also consider investing in ETFs, which provide exposure to a diversified portfolio of stocks or bonds, reducing your risk and increasing your potential returns.

Leveraging Singapore Savings Bonds

Another investment product that you can consider with a CDP account is the Singapore Savings Bond (SSB). SSBs are a low-risk, fixed income investment product issued by the Singapore government, offering a competitive interest rate and flexible investment terms.

With a CDP account, you can easily purchase and manage your SSB investments, giving you greater control over your fixed income portfolio. You can also choose to reinvest your interest payments, compounding your returns over time.

By opening a CDP account and leveraging the investment products available to you, you can maximise your investment potential and achieve your financial goals. So why wait? Start exploring your options today and take control of your financial future!

Frequently Asked Questions

How can I swiftly open a CDP account online using Singpass?

Opening a CDP account online is a simple and straightforward process that can be completed in a few simple steps. First, you need to have an existing bank account from one of the following banks: Citibank, DBS/POSB, HSBC, Maybank, OCBC, SCB or UOB. Then, you can apply for a CDP account using Singpass Myinfo. After selecting the sign-up method, you will be required to fill in your personal details, bank, and tax residence details, and upload your documents. Finally, you can review your application before submitting it. With Singpass, you can complete the entire process in just a few minutes.

What’s the excitement about opening a CDP account with DBS, and how do I get started?

DBS offers a seamless and hassle-free way to open a CDP account online. To get started, simply log in to your DBS iBanking account and click on the “Open a CDP Account” button. You will then be directed to the CDP website, where you can complete your application. Once your application is approved, you can start trading on the Singapore Exchange (SGX) using your DBS Vickers Online Trading account.

Are there any charges for kick-starting my investment journey with a Singapore CDP account?

Yes, there are charges associated with opening and maintaining a CDP account. The account opening fee is $10, while the annual account maintenance fee is $2.50. In addition, there are transaction fees for buying and selling shares on the SGX. However, these fees are relatively low compared to other markets, making the SGX an attractive option for investors.

How quickly can I dive into the trading world after my CDP account gets approved?

Once your CDP account is approved, you can start trading on the SGX immediately. However, it is important to note that you will need to open a brokerage account with a licensed broker in order to buy and sell shares. This can be done online or in person, depending on the broker.

What’s the buzz about managing my CDP account through an app, and how does it work?

Managing your CDP account through an app is a convenient and efficient way to stay on top of your investments. Many brokers offer mobile apps that allow you to view your portfolio, monitor market news and trends, and place trades on the go. Some apps even offer advanced features such as real-time price alerts and customized watchlists.

Can I effortlessly log into my CDP account using SGX credentials?

Yes, you can log into your CDP account using your SGX credentials. Simply go to the CDP website and click on the “Login with SGX” button. You will then be directed to the SGX website, where you can enter your login details. Once you have logged in, you can access your CDP account and manage your investments.