Are you looking to invest in the Singapore stock market? If so, one of the first steps you need to take is to choose the right stock broker. With so many options available, it can be overwhelming to decide which broker to go with. This article will provide you with a comprehensive guide to comparing Singapore stock brokers, so that you can make an informed decision.

When choosing a Singapore stock broker, there are several factors to consider. Firstly, you need to think about the type of account you want to open and the investment products you want to trade. You should also consider the fees and charges associated with each broker, as well as any promotions or resources they offer to enhance your trading experience.

By comparing Singapore stock brokers, you can find the one that best suits your needs and maximise your returns. This article will provide you with all the information you need to make an informed decision, including tips on how to choose the right broker, an overview of the different account types and investment products available, and a breakdown of fees and charges. You will also learn how to enhance your trading experience and take advantage of promotions and resources offered by different brokers.

Choosing the Right Singapore Stock Broker

When it comes to investing in the stock market, choosing the right Singapore stock broker is crucial. With so many options available, it can be overwhelming to decide which one to go with. In this section, we will discuss the key factors to consider when choosing a Singapore stock broker.

Comparing Brokerage Fees

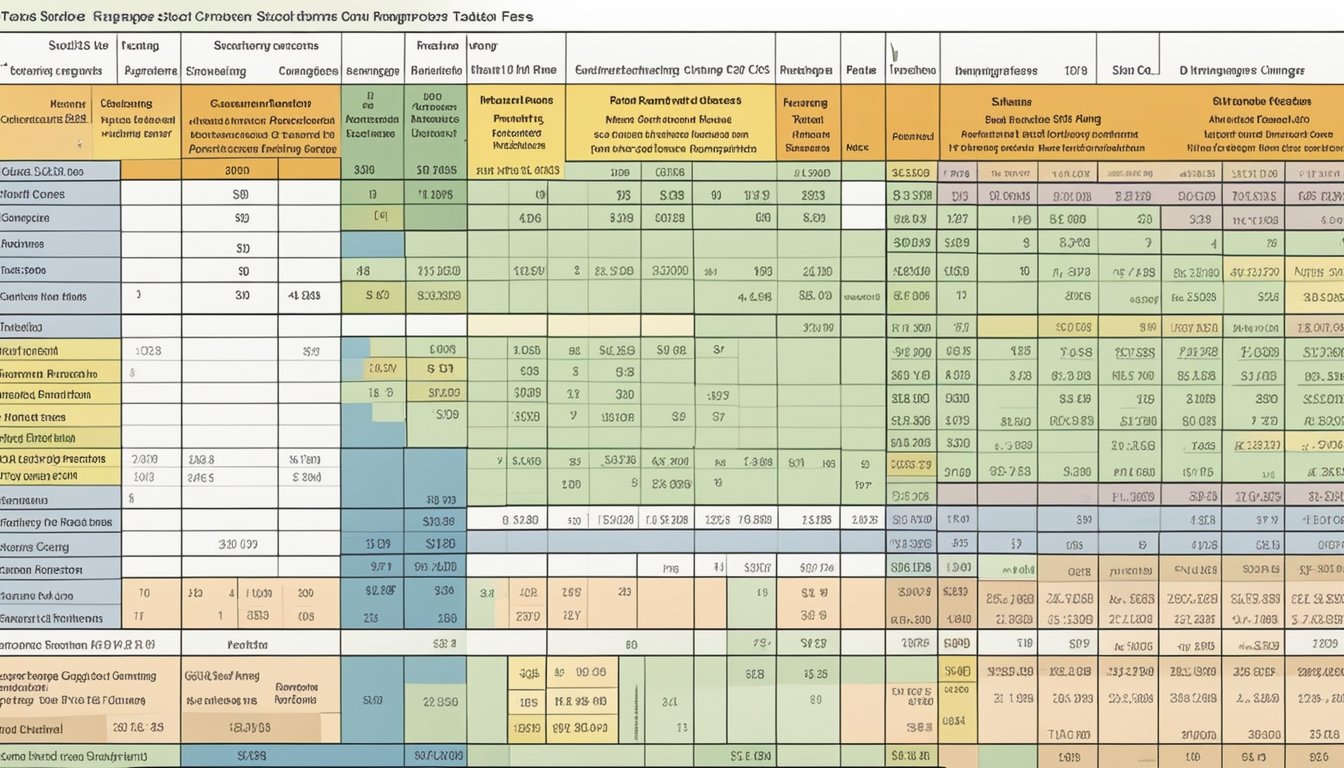

One of the most important factors to consider when choosing a Singapore stock broker is the brokerage fee. This is the fee charged by the broker for executing trades on your behalf. Different brokers have different fee structures, so it’s important to compare them carefully.

For example, Webull is currently offering a promotion where you can trade SG stocks for S$0 commission for up to 3 years. This makes them the cheapest investment brokerage on the market for Singapore stocks at the moment. On the other hand, DBS Vickers Cash Upfront is a good option for buy and hold investors, as they offer a lower fee structure for long-term investments.

Assessing Platform Features

Another important factor to consider when choosing a Singapore stock broker is the platform features. This includes the trading platform, research tools, and other features offered by the broker.

For example, Interactive Brokers, CMC Invest, SAXO Markets, and ProsperUS are some of the best brokers for overseas stocks, as they offer access to global markets. Saxobank is also a good option for cash and margin trading across global markets, as they offer advanced tools, trading insights, and comprehensive market research.

Understanding Market Access

Finally, it’s important to consider the market access offered by the broker. This includes the markets that you can trade in and the types of securities that are available.

For example, Tiger Brokers is a good option for trading in the US market, as they offer access to over 100 global exchanges. Moomoo is another good option for trading in the US market, as they offer commission-free trading for US stocks and ETFs. Syfe Trade and USmart are also good options for trading in the US market, as they offer low fees and access to a wide range of securities.

In conclusion, when choosing a Singapore stock broker, it’s important to compare the brokerage fees, assess the platform features, and understand the market access offered by the broker. By considering these factors carefully, you can choose a broker that meets your investment needs and helps you achieve your financial goals.

Account Types and Investment Products

When it comes to choosing a stock brokerage account in Singapore, understanding the different account types and investment products available is crucial. In this section, we’ll explore the different types of accounts available, and the investment products you can trade on each account.

Custodian vs CDP-Linked Accounts

The two main types of accounts available are custodian accounts and CDP-linked accounts. Custodian accounts are held with the broker, and the broker holds the securities on your behalf. On the other hand, CDP-linked accounts are linked to your Central Depository (CDP) account, and you hold the securities in your own name.

While custodian accounts may be more convenient for some investors, CDP-linked accounts offer greater security and transparency. With a CDP-linked account, you have direct ownership of the securities you hold, and you can easily transfer them to another broker if you choose to do so.

Diverse Trading Products

When it comes to trading products, most brokers in Singapore offer a wide range of investment products, including stocks, ETFs, options, securities, futures, REITs, and mutual funds. This diversity of trading products allows you to build a well-diversified portfolio that suits your investment goals and risk tolerance.

It’s important to note that not all brokers offer the same investment products, and some may specialize in certain types of investments. For example, some brokers may be better suited for trading futures or options, while others may have a wider selection of ETFs or mutual funds.

When choosing a broker, it’s important to consider the investment products you want to trade, and ensure that the broker offers those products at competitive prices. Additionally, you may want to consider the broker’s research and analysis tools, which can help you make informed investment decisions.

Overall, understanding the different account types and investment products available is crucial when choosing a stock brokerage account in Singapore. By choosing a broker that offers the investment products you want to trade, and the account type that suits your needs, you can build a well-diversified portfolio that helps you achieve your investment goals.

Fees and Charges Explained

Investing in the stock market can be a lucrative way to grow your wealth, but it’s important to understand the fees and charges associated with opening and maintaining a brokerage account. In this section, we’ll explain the various fees you can expect to encounter when opening a Singapore stock brokerage account.

Understanding Commission Fees

Commission fees are the most common fees charged by brokerage firms and are typically calculated as a percentage of the total trade value. For example, if you buy $10,000 worth of shares and the commission fee is 0.1%, you would pay a commission fee of $10. It’s important to note that some brokerage firms may have a minimum commission fee, which means you’ll pay a set fee regardless of the trade value.

When comparing commission fees, it’s important to consider the minimum commission fee, as well as the percentage charged. Some brokerage firms may have a low percentage commission fee, but a high minimum commission fee, which can make trading small amounts of shares expensive.

Hidden Costs to Watch Out For

In addition to commission fees, there may be other fees and charges associated with opening and maintaining a brokerage account. Some of these fees may be hidden or not immediately obvious, so it’s important to read the fine print before opening an account.

One common fee is the platform fee, which is charged for using the brokerage firm’s trading platform. Platform fees can be a flat fee or a percentage of the total trade value. Some brokerage firms may also charge a custody fee, which is a fee for holding your shares in custody.

Another fee to watch out for is the trading fee, which is charged for each trade you make. Trading fees can be a flat fee or a percentage of the total trade value. Some brokerage firms may also have a minimum fee per trade, which means you’ll pay a set fee regardless of the trade value.

It’s important to keep in mind that fees and charges can add up over time, so it’s important to choose a brokerage firm with fees that fit your trading style and budget. By understanding the various fees and charges associated with opening and maintaining a brokerage account, you can make an informed decision and avoid any surprises down the road.

Enhancing Your Trading Experience

As a trader, you want to have a smooth and hassle-free experience when trading in the stock market. Fortunately, Singapore has a plethora of online stock brokerage accounts that offer user-friendly tools and platforms to enhance your trading experience.

User-Friendly Tools and Platforms

When selecting a stock brokerage account, it is essential to consider the user-friendliness of the trading platform. The trading platform should be easy to navigate, with clear and concise instructions. Some online trading platforms offer demo accounts, allowing you to practice trading without risking your hard-earned money.

In addition, a good trading platform should provide market data that is easy to understand and analyze. This data should be presented in a clear and organized manner, allowing you to make informed trading decisions.

Mobile and Desktop Trading

Nowadays, most stock brokerage accounts offer mobile and desktop trading options. This allows you to trade on-the-go, ensuring that you do not miss out on any trading opportunities. Mobile trading is especially important if you have a busy schedule and cannot monitor the stock market throughout the day.

When selecting a stock brokerage account, ensure that the mobile and desktop trading options are user-friendly and offer the same features as the web-based platform. This will ensure that you have a seamless trading experience, regardless of the device you use.

Overall, selecting a stock brokerage account with user-friendly tools and platforms, as well as mobile and desktop trading options, can enhance your trading experience. It is also important to consider other factors such as leverage, regular savings plan, and bank transfer options when selecting a stock brokerage account.

Maximising Returns through Promotions and Resources

When it comes to investing in Singapore, you want to make sure you’re getting the most out of your brokerage account. One way to do this is by taking advantage of promotions and resources offered by your broker. In this section, we’ll explore how you can maximise your returns through promotions and resources.

Brokerage Promotions and Offers

Brokerages in Singapore are constantly vying for your business, and one way they do this is by offering promotions and offers to entice you to sign up or make more trades. These promotions can come in the form of commission fee waivers, lowered commissions, vouchers, and cash rebates.

For example, Webull is currently offering a promotion where you can trade SG stocks for S$0 commission for up to 3 years. This is a great way to save money on trading fees and maximise your returns.

It’s important to note that not all promotions are created equal, and you should carefully read the terms and conditions before taking advantage of any offer. Some promotions may have restrictions or requirements that may not be suitable for your investment goals.

Financial Insights and News

In addition to promotions, many brokerages offer financial insights and news to help you make informed investment decisions. These resources can include market analysis, stock recommendations, and economic news.

For example, Saxo Markets offers daily market briefs that provide a summary of the latest market trends and news. This can be a valuable resource for staying up-to-date on the latest developments and making informed investment decisions.

However, it’s important to remember that not all financial insights and news are created equal. Some may be biased or inaccurate, so it’s important to do your own research and verify any information before making any investment decisions.

Overall, by taking advantage of promotions and resources offered by your broker, you can maximise your returns and make informed investment decisions. Just be sure to read the fine print and do your own research to ensure you’re getting the best deal possible.

Frequently Asked Questions

What are the top-rated brokerage accounts available in Singapore?

If you’re looking for the top-rated brokerage accounts in Singapore, you can consider Interactive Brokers, CMC Invest, SAXO Markets, and ProsperUS. These brokers offer a range of investment options, including stocks, ETFs, and bonds, and provide competitive commission rates.

How can one identify the most affordable brokerage fees in Singapore?

To identify the most affordable brokerage fees in Singapore, you should compare the commission rates offered by different brokers. Look for brokers that offer low commission rates and have no hidden fees. You can also consider newer brokers like Webull, which offer commission-free trading for up to three years.

Could you list the leading stock brokers currently operating in Singapore?

Some of the leading stock brokers currently operating in Singapore include Interactive Brokers, CMC Invest, SAXO Markets, and ProsperUS. These brokers offer a range of investment options, including stocks, ETFs, and bonds, and provide competitive commission rates.

Which trading platform in Singapore is most suitable for novices?

If you’re a novice investor, you may want to consider Webull or uSMART as your trading platform in Singapore. These platforms offer user-friendly interfaces and educational resources to help you get started with investing.

Who stands out as the premier broker for options trading in the Lion City?

When it comes to options trading in Singapore, Interactive Brokers is one of the premier brokers. They offer a range of investment options, including options trading, and provide competitive commission rates.

Are there any brokerage platforms in Singapore offering commission-free trading?

Yes, there are brokerage platforms in Singapore that offer commission-free trading. For example, Webull currently offers commission-free trading for up to three years for Singapore stocks. However, it’s important to note that commission-free trading may come with certain restrictions or limitations.