FastSaver is a high-interest savings account offered by CIMB Singapore. If you’re looking for a savings account that offers competitive interest rates, then FastSaver might be the right option for you. In this article, we’ll take a closer look at FastSaver interest rates in Singapore, and how you can maximise your savings with this account.

Understanding FastSaver Interest Rates

FastSaver offers a competitive interest rate of up to 1.50% p.a. on your savings. To qualify for this interest rate, you’ll need to deposit a minimum of $1,000 and maintain that balance in your account. Additionally, there are no multiple conditions that you need to meet to earn this interest rate, making it a simple and straightforward way to grow your savings.

Eligibility and Account Opening

To open a FastSaver account, you’ll need to be at least 16 years old and have a valid Singapore NRIC or passport. You can apply for a FastSaver account online or at any CIMB Singapore branch. The account opening process is quick and easy, and you can start earning interest on your savings as soon as your account is activated.

Key Takeaways

- FastSaver is a high-interest savings account offered by CIMB Singapore.

- FastSaver offers a competitive interest rate of up to 1.50% p.a. on your savings with no multiple conditions.

- To open a FastSaver account, you’ll need to be at least 16 years old and have a valid Singapore NRIC or passport.

Understanding FastSaver Interest Rates

If you’re looking for a high-interest savings account in Singapore, CIMB FastSaver is a great option. The account offers a base interest rate and bonus interest rates that can help you earn more on your savings.

Base Interest Rate

To earn the base interest rate of up to 0.3% p.a. on your savings, you need to maintain a minimum balance of $1,000 in your account. The interest is accrued daily and credited monthly, so you can see your savings grow over time.

Bonus Interest Rates

CIMB FastSaver also offers bonus interest rates of up to 1.2% p.a. on your savings. To qualify for the bonus interest rates, you need to meet certain criteria, such as:

- Maintaining a minimum average daily balance of $50,000 in your account

- Making a minimum deposit of $1,000 into your account every month

- Signing up for a CIMB Visa Signature Card and spending a minimum of $800 per month on the card

By meeting these criteria, you can earn bonus interest rates on top of the base interest rate, which can help you maximise your savings.

CIMB FastSaver’s interest rates are competitive with other savings accounts in Singapore, making it a great option for anyone looking to grow their savings. Keep in mind that interest rates can fluctuate over time, so it’s important to monitor your account regularly to ensure you’re earning the maximum interest rate possible.

Overall, CIMB FastSaver is a great choice for anyone looking to earn a competitive interest rate on their savings. With both base and bonus interest rates available, you can maximise your savings and watch your money grow over time.

Eligibility and Account Opening

If you are interested in opening a CIMB FastSaver account, there are a few things you need to know about eligibility and account opening. In this section, we will cover the minimum age, necessary documents, and MyInfo requirements for opening a FastSaver account.

Minimum Age

To open a CIMB FastSaver account, you need to be at least 16 years old. If you are under 18, you will need a parent or legal guardian to accompany you to the bank to open the account.

Necessary Documents

When applying for a CIMB FastSaver account, you will need to provide some necessary documents. These documents include your NRIC or passport and proof of address. You can use your utility bill or bank statement as proof of address. If you are a foreigner, you will need to provide additional documents, such as your work permit or employment pass.

MyInfo

CIMB FastSaver account opening process is made easy with MyInfo. MyInfo is a secure and convenient way to retrieve your personal information from government agencies, such as the Immigration and Checkpoints Authority (ICA) and the Inland Revenue Authority of Singapore (IRAS). With MyInfo, you can easily fill in your personal details and skip the manual process of filling in forms.

In conclusion, opening a CIMB FastSaver account is a straightforward process, provided you meet the eligibility criteria and have the necessary documents. With MyInfo, you can easily complete your account opening process without having to fill in lengthy forms manually. So, if you are looking for a high-interest savings account with no multiple conditions, CIMB FastSaver could be the perfect choice for you.

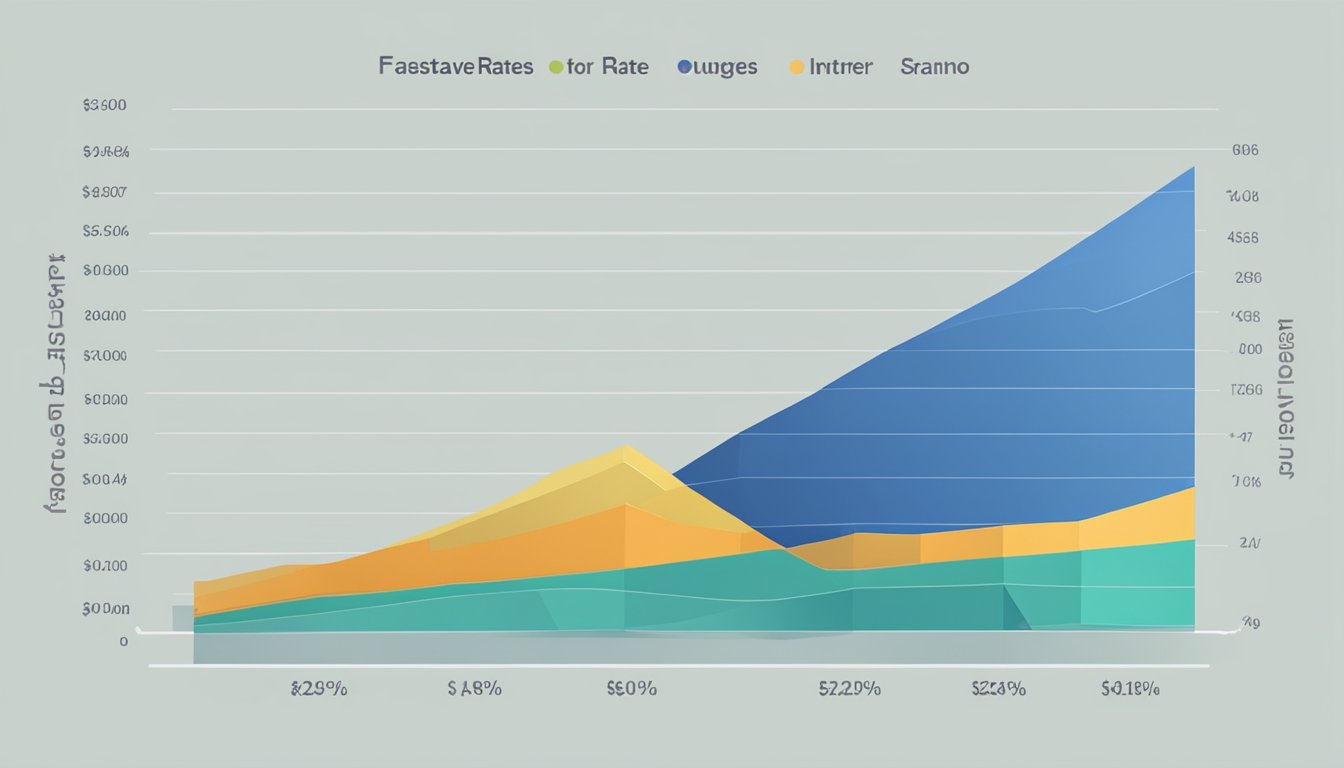

Maximising Savings with FastSaver

Are you looking for a high-interest savings account in Singapore that can help you maximise your savings? Look no further than the CIMB FastSaver account. With a maximum interest rate of 3.50% p.a., this no-frills account can help you grow your money quickly and easily.

Salary Credit

One of the easiest ways to maximise your savings with FastSaver is by setting up a salary credit. By doing so, you can earn up to 1.00% p.a. bonus interest on your first S$10,000 account balance. Simply make sure that your salary is credited into your FastSaver account every month to enjoy this bonus interest rate.

Credit Card Spend

Another way to increase your savings with FastSaver is by using a CIMB credit card. By spending at least S$800 on your CIMB credit card each month, you can earn up to 1.00% p.a. bonus interest on your first S$10,000 account balance. Plus, you’ll enjoy all the benefits of your CIMB credit card, such as cashback and rewards points.

Increase Account Balance

Of course, one of the most straightforward ways to maximise your savings with FastSaver is by increasing your account balance. With a maximum interest rate of 3.50% p.a., the more money you have in your account, the more interest you’ll earn. And with no fall-below monthly fees, you won’t be penalised for keeping a high balance.

So if you’re looking to save more money and earn more interest, the CIMB FastSaver account is the perfect choice for you. Whether you choose to credit your salary, spend on your CIMB credit card, or simply increase your account balance, you can enjoy high interest rates and hassle-free banking.

Comparing FastSaver with Other Savings Accounts

If you’re looking for a high-interest savings account in Singapore, you may have come across CIMB FastSaver. But how does it compare to other savings accounts in the market? Let’s take a closer look.

OCBC 360 Account

OCBC 360 is a popular savings account that offers up to 3.45% p.a. interest. However, to earn this interest, you need to fulfill certain conditions such as credit card spend, salary credit, and investment with OCBC. On the other hand, CIMB FastSaver offers a competitive base interest rate ranging from 0.80% to 1.50% p.a. depending on the amount of money saved, without any additional conditions.

DBS Multiplier Account

DBS Multiplier is another savings account that offers higher interest rates for fulfilling certain conditions such as salary credit, credit card spend, home loan installment, and insurance. The interest rates can go up to 3.80% p.a. However, if you don’t fulfill these conditions, the interest rate drops significantly. In contrast, CIMB FastSaver offers a consistent interest rate without any conditions.

UOB One Account

UOB One is a savings account that offers tiered interest rates based on the amount of money saved and the number of conditions fulfilled such as salary credit, credit card spend, and investment with UOB. The interest rates can go up to 1.50% p.a. However, if you don’t fulfill these conditions, the interest rate drops significantly. CIMB FastSaver offers a higher base interest rate without any additional conditions.

Overall, CIMB FastSaver offers a competitive interest rate without any additional conditions, making it a convenient and hassle-free option for those who want to earn higher interest on their savings. However, if you’re willing to fulfill certain conditions, you may be able to earn higher interest rates with other savings accounts such as OCBC 360, DBS Multiplier, and UOB One.

Additional Benefits and Features

CIMB FastSaver is not only a high-interest savings account, but it also comes with a range of additional benefits and features that make it a great choice for your savings needs. Here are some of the additional benefits and features that you can enjoy with CIMB FastSaver:

Internet Banking

With CIMB FastSaver, you can access your account anytime, anywhere through CIMB Clicks internet banking. This means that you can check your account balance, view your transaction history, and transfer funds between your CIMB accounts with ease. CIMB Clicks is a secure and convenient way to manage your finances, and it is available 24/7.

Debit and ATM Cards

CIMB FastSaver comes with a CIMB ATM card that allows you to withdraw cash from any CIMB ATM in Singapore. You can also use your CIMB ATM card to make purchases at any merchant that accepts NETS payments. Additionally, you can apply for a CIMB Visa Signature debit card, which offers cashback on your spending and other exclusive benefits.

Insurance Products

CIMB FastSaver customers can also enjoy exclusive insurance products from CIMB. These include personal accident insurance, travel insurance, and home insurance. These insurance products offer comprehensive coverage at competitive rates, and they are designed to provide you with peace of mind.

Overall, CIMB FastSaver is a great choice for anyone who wants to earn high interest on their savings while enjoying a range of additional benefits and features. With internet banking, debit and ATM cards, and exclusive insurance products, CIMB FastSaver is a comprehensive savings solution that can help you achieve your financial goals.

Frequently Asked Questions

How can I calculate the earnings from my FastSaver account?

To calculate the earnings from your FastSaver account, you can use the following formula:

Interest earned = (Account balance x Interest rate) / 365 x Number of days

What are the current interest rates for the CIMB FastSaver savings account?

As of February 2024, the interest rate for the CIMB FastSaver account is 0.3% p.a. for the first S$10,000 and 0.6% p.a. for balances above S$10,000. However, it is important to note that interest rates are subject to change, and it is advisable to check the official CIMB website for the latest rates.

Are there any minimum balance requirements for the CIMB FastSaver Account?

Yes, there is a minimum balance requirement of S$1,000 to start earning interest on your FastSaver account. However, there are no fall-below monthly fees, which means that you will not be charged any fees if your account balance falls below the minimum balance requirement.

How does the CIMB FastSaver compare to the StarSaver in terms of benefits?

The CIMB FastSaver account offers higher interest rates than the StarSaver account. Additionally, the FastSaver account does not have any fall-below monthly fees, while the StarSaver account charges a monthly fee of S$5 if your account balance falls below S$5,000.

Are there any fees if my FastSaver account balance falls below a certain amount?

No, there are no fall-below monthly fees for the FastSaver account. However, you will need to maintain a minimum balance of S$1,000 to start earning interest on your account.

Which Singaporean bank offers the most attractive interest rates for savings accounts?

While CIMB FastSaver offers competitive interest rates for savings accounts, it is important to compare rates from different banks to find the most attractive option for your needs. Some other banks that offer high-interest savings accounts include DBS, OCBC, and UOB.