If you’re a business owner looking to secure a loan, one of the most important factors to consider is the interest rate. The interest rate determines how much you’ll pay in addition to the principal amount borrowed, so it’s essential to understand what average business loan interest rates are and how they can affect your business.

The average business loan interest rate can vary depending on the lender, loan amount, and creditworthiness of the borrower. However, according to recent data, the average interest rate for small business loans is around 3% to 6%. This rate can be higher or lower depending on the type of loan, with secured loans typically having lower interest rates than unsecured loans.

Understanding business loan interest rates is crucial if you want to make informed decisions about your business finances. By knowing what to expect, you can compare different lenders and loan options to find the best rate and terms for your business needs. In the following sections, we’ll explore more about business loan interest rates and how to find the right loan for your business.

Key Takeaways

- The average business loan interest rate varies depending on several factors, such as the lender, loan amount, and creditworthiness of the borrower.

- Secured loans generally have lower interest rates than unsecured loans.

- Understanding business loan interest rates is essential for comparing lenders and finding the right loan for your business.

Understanding Business Loan Interest Rates

When you’re considering taking out a business loan, one of the most important factors to consider is the interest rate. Interest rates can vary depending on a number of factors, including the type of loan you’re applying for, your credit score, and the lender you’re working with. In this section, we’ll take a closer look at what you need to know about business loan interest rates.

Factors Influencing Interest Rates

There are several factors that can influence the interest rate you’ll be offered for a business loan. These include your credit score, the amount of the loan, the term of the loan, and the collateral you’re able to provide. Lenders will also consider factors like your cash flow and business finances when determining your interest rate.

Types of Business Loans and Their Rates

Different types of business loans will have different interest rates. For example, SBA loans typically have lower interest rates than unsecured loans. Equipment financing loans may have higher interest rates than term loans. It’s important to understand the different types of loans available to you and the interest rates associated with each.

Calculating Your Interest Costs

Before you take out a business loan, it’s important to understand how much you’ll be paying in interest over the life of the loan. You can use a business loan calculator to estimate your total cost, including interest and fees. Be sure to consider the factor rate or effective interest rate (EIR), which takes into account any fees associated with the loan.

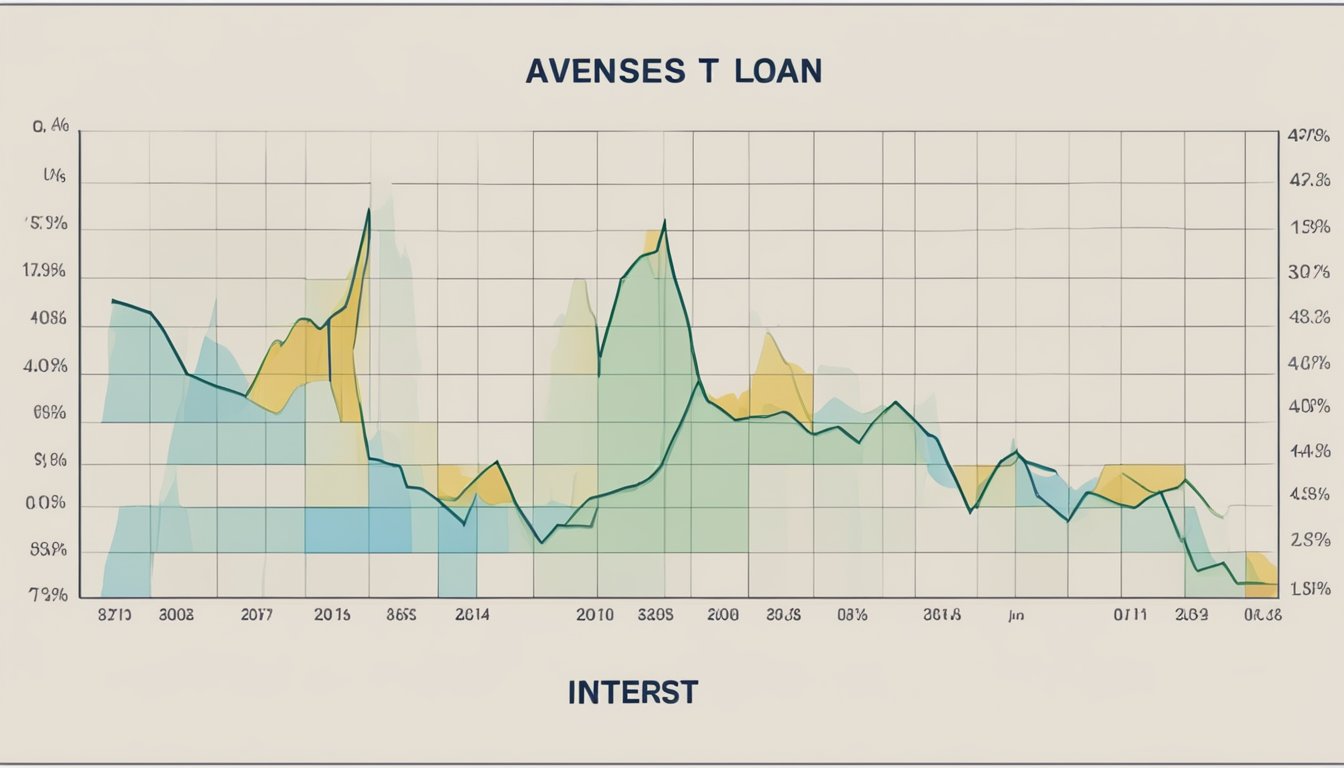

Current Trends in Business Loan Interest Rates

Business loan interest rates can fluctuate over time. Currently, interest rates are relatively low due to the economic impact of COVID-19. However, it’s important to keep an eye on economic changes that could impact interest rates in the future.

How to Secure Better Rates

There are several steps you can take to secure better interest rates on your business loan. Improving your credit score, providing collateral, and shopping around for different lenders can all help you secure better rates. You may also want to consider alternative lenders or government schemes that offer lower interest rates.

Impact of Economic Changes on Rates

Economic changes, such as inflation or changes to the federal funds rate or prime rate, can impact business loan interest rates. It’s important to stay informed about economic trends and how they could impact your interest rates over time.

Overall, understanding business loan interest rates is an important part of the loan application process. By considering the factors that influence interest rates, understanding the types of loans available to you, and calculating your interest costs, you can make an informed decision about which loan is right for your business.

Finding the Right Loan for Your Business

As a small and medium-sized enterprise (SME) owner, finding the right business loan to grow your business can be challenging. With so many loan options available, it can be difficult to know which one is right for you. In this section, we’ll explore the different loan options available and provide tips on how to evaluate them.

Evaluating Loan Options for SMEs

When evaluating loan options for your SME, it’s important to consider factors such as the loan amount, interest rate, repayment period, and any fees or charges that may be associated with the loan. You should also consider whether the loan is secured or unsecured, and whether you’re comfortable with the level of risk involved.

Alternative Financing and Modern Lenders

In addition to traditional bank loans, there are a number of alternative financing options available for SMEs. These include online business loans, merchant cash advances, and factoring or invoice financing. These modern lenders often have streamlined application processes, faster approval times, and more flexible repayment terms than traditional lenders.

Navigating Government-Backed Loans and Schemes

The government offers a number of loan schemes and initiatives to help SMEs access financing. These include the Government Risk Share (GRS) scheme, Temporary Bridging Loan Programme, and the SME Working Capital Loan. These loans often have lower interest rates and more flexible repayment terms than traditional bank loans.

The Role of Industry and Business Type

The type of industry and business you’re in can also impact the loan options available to you. For example, some lenders may specialise in lending to specific industries, such as healthcare or technology. It’s important to research lenders that have experience working with businesses in your industry.

Strategies for Startups and Newer Businesses

Startups and newer businesses may have a harder time accessing financing than more established businesses. However, there are still loan options available, such as startup business loans and unsecured business term loans. These loans may have higher interest rates and stricter eligibility requirements, but they can provide the financing needed to get your business off the ground.

When evaluating loan options, it’s important to consider your business’s growth potential, annual revenue, turnover, and risk share. By doing your research and carefully evaluating your options, you can find the right loan to help your business grow and succeed.

Frequently Asked Questions

How can you determine a competitive interest rate for your new enterprise’s loan?

When researching business loan interest rates, it’s important to consider the type of loan you’re looking for, as well as the lender’s requirements. You can compare rates from different lenders and use online tools to calculate your repayments. It’s also worth considering the current market trends and economic conditions.

What are the current trends in interest rates for SME Working Capital loans?

The current interest rates for SME Working Capital loans in Singapore range from 3% to 8%, depending on the lender and the borrower’s creditworthiness. These rates are subject to change based on market conditions and the lender’s policies.

Could you tell me the typical interest rates for corporate financing in Singapore?

The typical interest rates for corporate financing in Singapore vary depending on the size of the loan, the borrower’s creditworthiness, and the lender’s policies. On average, interest rates range from 5% to 10%, but this can vary widely based on the lender and the borrower’s circumstances.

What factors influence the interest rate offered to a sole proprietorship?

The interest rate offered to a sole proprietorship depends on several factors, including the borrower’s credit score, the size of the loan, and the lender’s policies. Other factors that may influence the interest rate include the borrower’s industry, the length of time in business, and the borrower’s financial history.

How do interest rates for startup loans in Singapore compare to established businesses?

Interest rates for startup loans in Singapore are generally higher than those for established businesses. This is because startups are considered riskier investments for lenders. However, interest rates can vary widely depending on the lender and the borrower’s creditworthiness.

Are there any tools available to help calculate potential repayments on business loans?

Yes, there are several online tools available to help you calculate potential repayments on business loans. These tools take into account the loan amount, interest rate, and repayment period to give you an estimate of your monthly repayments. It’s important to note that these tools are only estimates and may not reflect the actual repayments you’ll make.